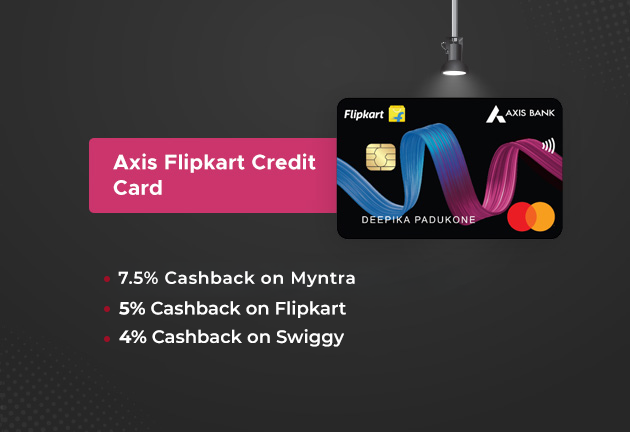

Axis Flipkart Credit Card – Enjoy accelerated cashback across all your favorite categories!

- High Cashback on Partner Platforms

- Exclusive Flipkart and Cleartrip Offers

- Rewards on Everyday Spends

- Dining Privileges with EazyDiner

- Fuel Surcharge Waiver

- Seamless Cashback Redemption

Product Highlights

- You Earn 7.5% Cashback with every transaction on Myntra (With a Rs 4,000 Cashback cap per quarter)

- Get 5% Cashback with every transaction on Flipkart (excluding Flipkart Health) and Cleartrip transactions (With a Rs 4,000 Cashback cap per merchant per quarter)

- Get 4% Cashback on Swiggy, PVR, Uber, and Cult.fit and 1% on other spends with no capping on Cashback

- Get 15% off upto Rs 500 with EazyDiner

- Get 1% fuel surcharge waiver on fuel purchases valid on transactions between Rs 400 – Rs 4000, capped at upto Rs 400

Rewards Point Redemption and Value

Reward points can be redeemed against Gift Vouchers and Airline Miles by the Primary Cardholder only

Reward points can be redeemed against Gift vouchers from brands like Amazon, Flipkart, Tanishq, Apple Imagine, Myntra, ShoppersStop & more

1 Reward point redemption value may vary between Rs 0.2-Rs 0.35 per point depending upon the gift voucher selected by the user

Fees & List of All Charges

Joining Fees: Rs 500 + GST

Annual fees: Rs 500 + GST

Get annual fee waiver on spending Rs 3,50,000 or more in a year

Documents Needed

ID Proof: PAN Card/Form 60/Passport

Address Proof: Aadhaar, Passport, or utility bills

Income Proof: Bank statements or salary slips/Form 16/ITR Return

Photograph: Recent passport-sized photo

Eligibility Criteria

Age: 21 to 65 years

Employment: Both salaried and self-employed individuals

Minimum Monthly Income: Rs 25,000

Self Employed: ITR > Rs 3,60,000/annum

Credit Score: 736+

New-to-Credit: Not Allowed

Important Terms & Conditions:

Please use your Aadhar linked Mobile number to complete the application

If you are an existing Axis Bank customer Please use the already registered mobile number to complete your application

Your full name is mandatory to apply for Axis Credit card, applications with a single name will not be accepted

If you were/are using any AXIS Credit card, you are not eligible for Profit

Tracking Time: 72Hrs after the Application ID Generation

Confirmation Timeline: Within 75 Days of Card Activation

A Minimum transaction of Rs 100 is required within 30 days to activate the card

If you apply for a different card upon redirecting you will be eligible for the profits rates applicable on the card applied

Profits on Axis Bank App applications: Not Applicable

Profit on Referral Earnings: Not Applicable