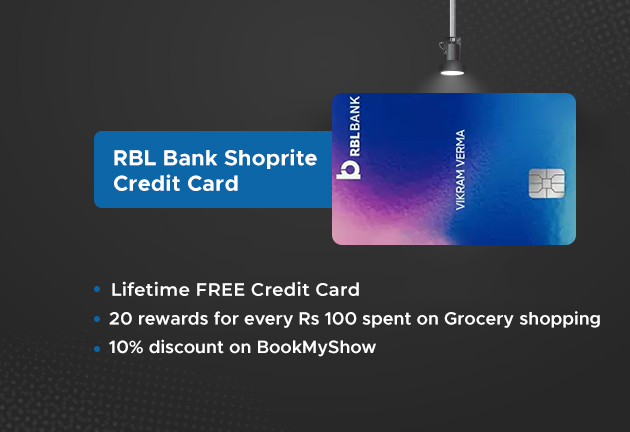

Save on Everyday Grocery Spends with RBL Bank Shoprite Credit Card

- Zero Joining Fee with Annual Fee Waiver

- Accelerated Grocery Rewards

- Exclusive Partner Discounts

- Reward Points on All Other Purchases

- Entertainment Offers on BookMyShow

- Fuel Surcharge Waiver

Product Highlights

Turn your daily expenses into savings with the RBL Bank Shoprite Credit Card — designed for smart shoppers who love rewards and discounts on essentials, dining, and entertainment.

- Zero Joining Fee – Get started absolutely free! Enjoy a spend-based annual fee waiver from the second year onwards.

- Accelerated Grocery Rewards – Earn a massive 20 Reward Points for every ₹100 spent on grocery shopping (1 RP = ₹0.25).

- Exclusive Partner Discounts – Enjoy amazing deals on top merchant platforms like Tata Cliq, Zomato, Swiggy, Zepto, and more.

- Everyday Rewards – Earn 1 Reward Point for every ₹100 spent on all other purchases.

- Entertainment Savings – Get 10% off on BookMyShow movie tickets (up to ₹100), valid 15 times per calendar year.

- Fuel Surcharge Waiver – Enjoy 1% waiver on fuel transactions between ₹500 and ₹4,000 across all petrol pumps (maximum waiver ₹100 per month).

Shop more, earn more, and enjoy the lifestyle benefits that make your everyday spending truly rewardingly.

Fees & List of All Charges

Joining Fees: Nil

Annual Fees: Nil

Fee of Rs 99 + GST is charged for redeeming reward points on RBL Bank Credit Cards

Documents Needed

ID Proof: PAN Card/Form 60

Address Proof: Aadhaar Authentication is required at the time of KYC

Eligibility Criteria

Required Age: 21 – 65 years

Employment status: Both Salaried and Self-Employed individuals are eligible

Income: Minimum monthly income of Rs 15,000

Self-Employed: Minimum income as filed in ITR Rs 2 lac/year

Credit score: Minimum credit score of 720+

New to Credit: Not Allowed

Important Terms & Conditions:

If you were/are using any RBL Credit Card, you are not eligible for Profit

Please use Aadhaar linked mobile number to fill the application

Tracking Time: 72Hrs after the Application ID Generation

Confirmation Timeline: Within 75 Days of Card Activation

Minimum transaction of Rs 100 is required within 30 days to activate the card

If you apply for a different card upon redirecting, you will be eligible for Profit rates applicable on the card applied

Profits on RBL Bank App Applications: Not Applicable

Profit on Referral Earnings: Not Applicable