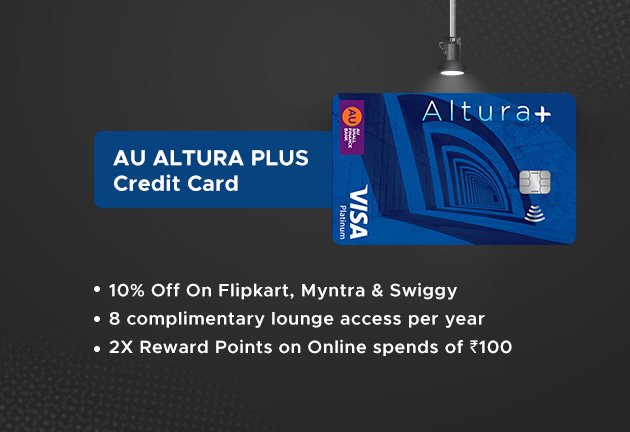

AU Altura Plus Credit Card – Enjoy the limitless spending and wide variety of benefits!

- Welcome Benefits & Activation Rewards

- High Cashback & Bonus Rewards

- 2X Rewards on Online Transactions

- Complimentary Railway Lounge Access

- Fuel Surcharge Waiver

- Easy EMI Conversion Facility

- Exclusive Partner Discounts & Monthly Offers

Product Highlights

Unlock a world of powerful rewards and premium lifestyle benefits with the AU Altura Plus Credit Card. From instant discounts to airport-style lounge comfort at railway stations, this card elevates your everyday spending with unmatched value.

- ₹500 Welcome Vouchers on spending just ₹10,000 within 60 days of setup

- ₹500 Bonus Reward Points (worth ₹125) every month you spend ₹20,000+ on retail

FEATURES THAT MAKE IT A MUST-HAVE

- 1.5% Cashback on all POS retail spends (excl. fuel), with up to ₹100 cashback per billing cycle

- 2X Reward Points on every online transaction — shop more, earn faster

- 2 Complimentary Railway Lounge Access every quarter at top stations (Delhi, Jaipur, Kolkata-Sealdah, Ahmedabad & Agra)

- 1% Fuel Surcharge Waiver on transactions between ₹400 and ₹5,000 across India

- Instant EMI Conversion on purchases ₹2,000+ with flexible tenures

PARTNER DISCOUNTS YOU’LL LOVE

- 5% Instant Discount at Croma (min. spend ₹15,000) – once per month15% Off on EasyDiner (min. spend ₹2,500; max ₹500)

- 15% Off on Tata CliQ (max ₹300) – monthly delight

- 15% Off Domestic Flights & 10% Off International Flights on Cleartrip – once per month

- 20% Off on Movie Tickets (max ₹100 per month)

- More exciting e-commerce offers ranging from 5% to 25%

Fees & List of All Charges

Joining Fees: Rs 499 + applicable taxes (Joining fees will be waived off, if the user spends Rs 20,000 within first 90 days of card issuance)

Annual Fees: Rs 499 + applicable taxes (Annual fees will be waived off, if the user spends Rs 80,000 within first anniversary year)

Documents Needed

Valid PAN Card

Aadhar Card – should be linked to Mobile (For EKYC)

Address proof

Income Proof (if opted for Income surrogate)

Eligibility Criteria

Required Age: 21-60 years

Employment status: Salaried or Self-Employed

Income: Rs 25,000 per month (Salaried and Self-employed)

Customers need to have an Existing card (6 months old) with a minimum limit of Rs 30,000

No Delayed Payments in the last 12 months

Required Credit Score: 700+

Important Terms & Conditions:

Please use your Aadhaar linked Mobile number to complete the application

Existing Customers (Savings/Current Account/Credit Cards/Loans/FD) of AU Bank are not eligible for Profit

Tracking Time: 72 Hours after the Application ID Generation

Missing Profit Tickets: Accepted

Confirmation Timeline: Within 75 Days of Card Activation

A Minimum transaction of Rs 100 is required within 30 days to activate the card

Card upgrades/limit enhancements are not a part of Profits

If you apply for a different card upon redirecting you will be eligible for the profit rates applicable on the card applied

Profits on AU Bank app applications: Not Applicable

Profit on Referral Earnings: Not Applicable